BLOG

Affordable upstate

Asset Allocation in the 2020s

U.S. investors find themselves in a new investing paradigm one year after COVID-19 arrived in the U.S.

The S&P 500 just set record highs above 4,000. The S&P is at a 34 price-to-earnings ratio, which according to economist Robert Shiller, means “stocks are in an extreme bubble.”

The most important price in the world (a.k.a. the price of money), U.S. 10-year treasuries have risen to 1.7% after closing at 0.53% in August 2020.

Bonds used to be an adequate income and savings vehicle when they yielded above 5%. At today’s low rates, they seem more like return-free risk due to increasing inflation.

Is inflation transitory as the Federal Reserve says, or have we finally turned the massive ship around on the 40-year deflationary trend?

Source: ©2009-2021 ZEROHEDGE.COM/ABC MEDIA, LTD

The S&P 500 just set record highs above 4,000. The S&P is at a 34 price-to-earnings ratio, which according to economist Robert Shiller, means “stocks are in an extreme bubble.”

The most important price in the world (a.k.a. the price of money), U.S. 10-year treasuries have risen to 1.7% after closing at 0.53% in August 2020.

Bonds used to be an adequate income and savings vehicle when they yielded above 5%. At today’s low rates, they seem more like return-free risk due to increasing inflation.

Is inflation transitory as the Federal Reserve says, or have we finally turned the massive ship around on the 40-year deflationary trend?

At the beginning of 2020, despite the President’s claims of the U.S. economy being “the greatest in the history of the country,” the U.S. faced a number of structural problems, including:

- Extreme over-indebtedness

- Deteriorating demographics

- Misallocation from the real sector to the financial sector

These issues have only intensified one year later. In response to the country rapidly shutting down due to COVID-19 outbreaks and falling markets, on March 23, 2020, the Federal Reserve launched unprecedented market interventions including:

- Purchasing an unlimited amount of U.S. government and mortgage-backed securities

- Purchasing corporate bonds, including junk bonds

- Providing financing directly to individual companies

- Growing its balance sheet from $4 to $7 trillion

- Reducing bank reserve requirement ratios to zero percent

- Providing forward guidance of short-term interest rates staying near zero until at least 2023, possibly 2025

These corporate solvency-ensuring operations were meant to “trickle-down” to save jobs. But the Fed’s increasing balance sheet went almost entirely to prop up asset prices, obliterating moral hazard and creative destruction.

Corporate managers learned price and liquidity is protected by the Fed, so they allocated more resources to financial investments (like stock buybacks) and less to real investment. The stock market used to be considered a leading economic indicator, but now it’s more a tool of monetary policy.

Since Biden took office, the government passed a $1.9 trillion stimulus package. The President just unveiled a $2 trillion infrastructure bill. In mid-April, Biden will unveil the second part of his recovery agenda focusing on the costs of health care, child care, and education. He is getting pressured to sponsor a fourth stimulus check bill and to make them regular $2,000 payments.

Given this backdrop, how should investors allocate their investments to achieve maximum returns while minimizing risk?

Many retail investors don’t follow the markets closely enough to feel confident they can predict ups and downs. So they make asset allocations that are designed to perform well on average through all market conditions.

The most popular asset allocation strategy for retail investors has been the risk parity portfolio based on modern portfolio theory, where investors allocate approximately 60% to stocks and 40% to bonds, depending on time horizon, risk tolerance, and goals.

At current extreme valuations, relying solely on stocks and bonds isn’t very appealing.

What other options exist?

Innovation in technology and regulation have decentralized access to private investment opportunities previously only available to institutional investors and family offices. Now, retail investors can access real estate, private equity, and venture capital opportunities.

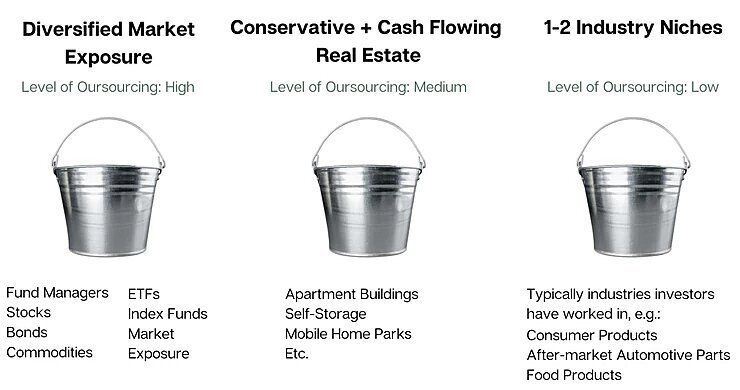

Families that have $25+mm in assets often use family offices to manage their wealth. According to Richard Wilson of Centimillionaire Advisors, they take a more diversified approach to asset allocation:

“The most consistent approach I have seen is taking three levels of outsourcing and control and diversifying across assets and control levels. I typically see families dividing things into three simple buckets"

Family offices use real estate and private equity investments to add uncorrelated streams of income to their portfolio. They do so because they can strengthen their portfolio’s anti-fragility and provide high cash flow and upside equity potential. Retail investors would be well-served to learn more about the upsides those investment sectors can bring to portfolio performance.

The information contained in this post is provided to you solely for informational purposes only, and is not to be shared, distributed, or otherwise used for any other purpose without direct reference to Affordable Upstate or link back to this post. This post is provided for education and discussion purposes only and does not constitute an offering. Opinions and projections included in this newsletter are provided as of the date of publication, may prove to be inaccurate, and are subject to change without notice. Prospective investors should not treat these materials as advice regarding legal, tax, or investment matters. No recommendations are made to invest in Affordable Upstate nor any other investment. An offering may be made only by delivery of a confidential offering memorandum to appropriate investors. Past performance is no guarantee of future results. Additional information about Affordable Upstate and its performance is available upon request.