BLOG

Affordable upstate

4 Factors Feeding the Housing Crisis in 2023

Who Can Buy a House Anymore?

The US is contending with a crisis of housing affordability in 2023. This crisis has been developing for years, slowly at first and then rapidly over the previous two. Put simply, in every major market (and most not-so-major ones), buying a home is no longer affordable for a family earning the median annual income.

Buying a home—once a pillar of the American Dream—is now a severe financial burden or simply out of reach for more than half of US households. And just about every number and metric you can find is trending in the wrong direction.

This month we’re taking a moment to work through the question: how did we get here?

A comprehensive answer would fill a small book (or several), so today we’ll examine just a few of the leading factors feeding the housing affordability crisis in 2023.

New Home Builds Not Keeping Pace

First, both nationally and in many local markets, new home builds simply aren’t keeping up with demand.

The reasons are numerous, and you can find well-researched explanations of everything from supply chain problems to zoning and permitting complexity among many others, but we’ll focus on just one cause: not enough workers.

The labor shortage in housing construction is not new: it started in 2008 as the housing bubble burst and the Great Recession began. At the risk of oversimplifying, people in the field found other jobs and didn’t look back, and far too few filled in behind them. Once the market was ready to build again, there weren’t enough people doing the building.

This labor shortage is a nationwide problem, with Moody’s estimating a shortfall of 1.5 million homes in the US and the National Association of Home Builders (NAHB) projecting a need for 2.2 million new hires through 2024. Unsurprisingly, the problem is concentrated in growth areas, including Sun Belt markets like Raleigh Durham, NC, and right here in Greenville County.

The math here doesn’t have to be complicated: if a market (or a nation) can’t build enough homes to meet demand, prices rise. And as prices rise, more and more would-be homeowners become mortgage-burdened or are priced out of the market entirely.

Rising Home Prices Coupled with Inflation

One of the most visible contributors to the housing crisis is the significant rise in home prices nationwide, including in Greenville County. The last several years have seen yearly jumps by 15% or more in the median price for existing homes, far outpacing wage growth.

Nationwide, the median home price has more than doubled from 2009 to 2022, and $100,000 of that rise in value has occurred since Q2 2020. Real median household income over that same span grew modestly from $63,000 to just over $70,000 in 2021— and actually declined noticeably from a 2019 peak.

Signs point to some wage growth in 2022, but nowhere near proportional to the increase in home prices.

While wages have grown only modestly, inflation throughout nearly every sector of the economy is causing households to stretch their wages further: if people are spending 8% more on groceries than a year ago, the difference has to come from somewhere. In many cases, it shows up as less money into savings (such as for a down payment).

To sum up: home prices are rising exponentially relative to income, even as inflation eats away at that income. It’s not a healthy place for would-be homeowners.

Rising Interest Rates

In an effort to rein in inflation, the Federal Reserve has aggressively increased interest rates, with seven consecutive rate hikes through 2022 and more projected for 2023. We could argue about how we got here regarding inflation and how printing billions in free money was bound to have some sort of downside (and boy do we have thoughts), but that’s a bit beside the point.

What is the point is that rising interest rates directly affect mortgage rates and thus the purchasing power of the average family. The goal here is to cool down spending by making borrowing more painful. But making borrowing more painful has a (perhaps unintended?) consequence: it makes buying a house more expensive and more difficult.

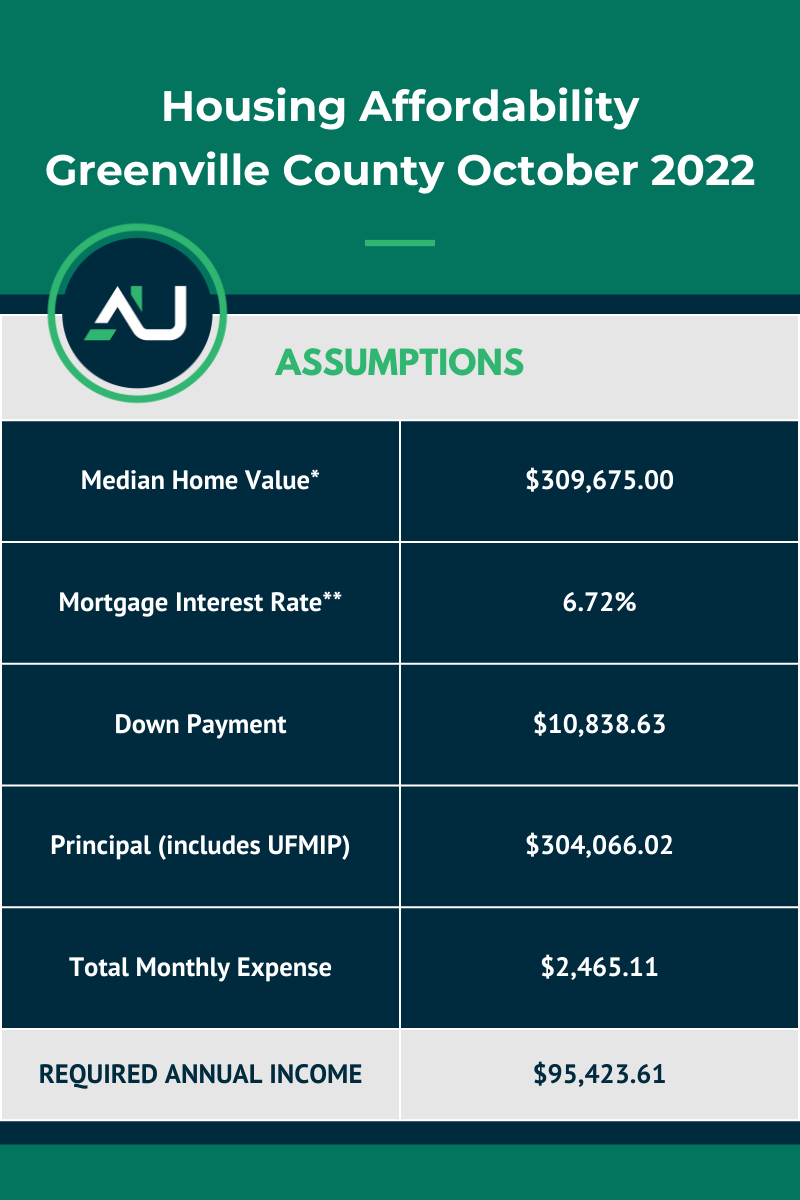

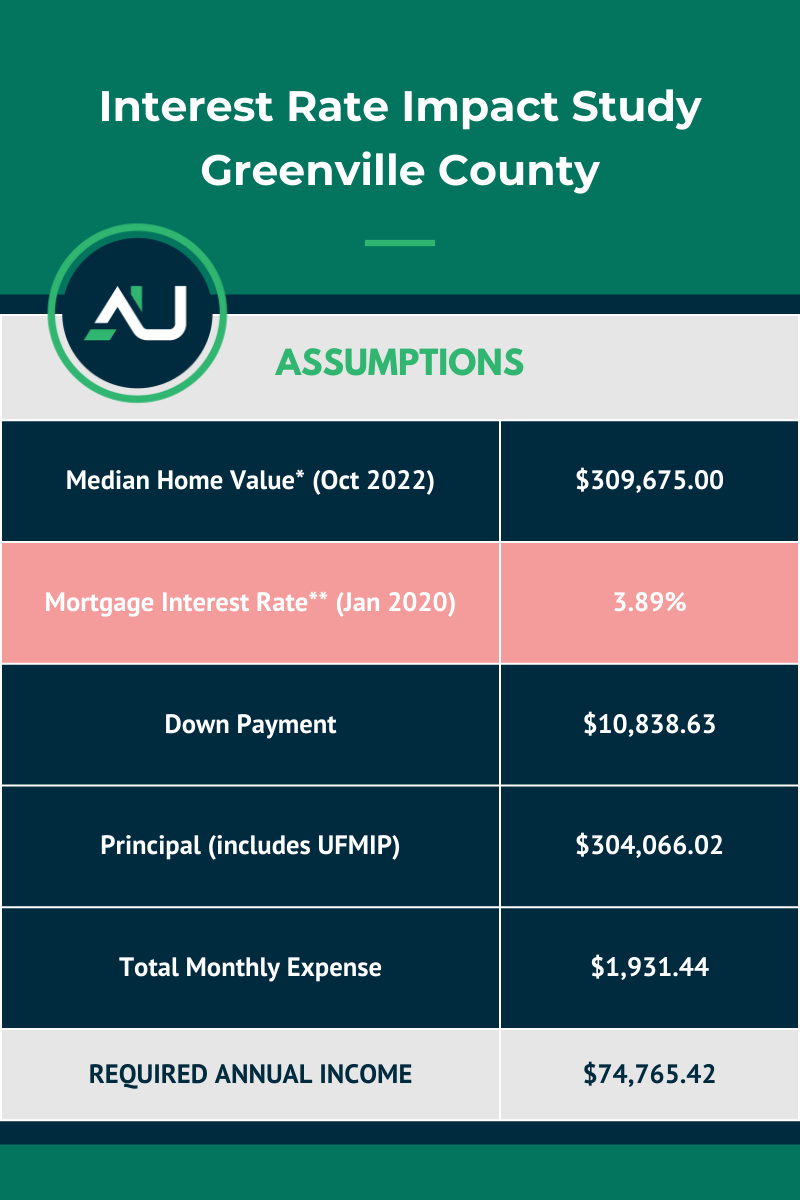

Let’s look at a local example. The October 2022 (most recent data available) median home value in Greenville County was $309,675. To buy a home affordably at that price in January 2020, a household would’ve needed an annual income around $75,000 considering the FHA mortgage interest rate of 3.89% (national rate in January 2020).

But to buy a home at the same price—down to the dollar—at today’s (Oct-22) FHA mortgage interest rate (6.72%), a family would need over $95,000 in annual income.

In this hypothetical, nothing changed about the home or its value. By changing the interest rate—and nothing else—purchasing a home affordably now demands a more than 25 percent increase in annual income.

Institutional Investors Constrain Single Family Homes Market

We’ll highlight just one more of the factors feeding today’s housing crisis: institutional investors hoovering up single family homes (SFHs) and turning them into single family rentals (SFRs) at an unprecedented rate.

These investment firms can pay cash (over asking price if needed), making them an attractive option for sellers. And they do offer some value, as there’s plenty of renter appetite for SFRs.

But in an already constrained market, taking as much as 20% of the available supply off the board entirely most certainly isn’t helping big-picture numbers like the median home value. The fewer available homes compared to buyers, the higher the prices go.

Worse, investors often target the lower-priced “starter home” category as the most rentable, pushing the dream of first-time home ownership ever higher in cost.

Cumulative Effect Even More Dire in Affordable Housing

The effect that these combined factors have on people living near the median income for their area is bad enough. But perhaps the worst part of all of this is the effect on those living below area median income (AMI).

When housing isn’t affordable for the typical median household, housing becomes a true crisis for those living on less. At 80% AMI, 50% AMI, or even lower, housing costs balloon to consume unsustainable percentages of household income.

The same pressures that exist on new and previously owned housing stock exist and may even be worse in rent markets, including affordable housing. When we’re already dealing with a constraint on new construction, the slice of that new construction that goes to affordable housing tends to shrink even further. And as the affordable housing supply dwindles far below demand, rents go up in that market as well— levied on renters least able to absorb the increase.

These are a few of the reasons Affordable Upstate exists: we preserve naturally occurring affordable housing (NOAH) in innovative ways that meet investor expectations with minimal impacts to rent, all while raising the quality of living for existing and future tenants.

Interested in diving deeper into the housing affordability crisis as it stands in 2023? Our nonprofit, SAHA [Southeast Affordable Housing Association], is publishing a white paper, A Deeper Look at the Housing Crisis in 2023, in just a few weeks. This white paper will take a much more detailed look at these factors as well as the reasons behind them.

Want to be the first to read this cutting-edge report?

Join the mailing list so you can read it as soon as it launches!