BLOG

Affordable upstate

Bracing for Stagflation: 5 Ways We’re Supporting Tenants & Safeguarding Investments

As we navigate the challenges of stagflation, I want to provide insight into how Affordable Upstate is addressing these economic headwinds. With a portfolio of 1,500 affordable units across the Carolinas and an average effective rent of $930, our residents are squarely in the crosshairs of the current economic environment. These units serve households earning modest incomes, many of whom are particularly vulnerable to rising costs and stagnant wages. Below, I’ll share the five key initiatives we’ve implemented to support our residents while protecting your investments.

1. Open and Transparent Communication

We believe that communication is the foundation of strong tenant relationships. To ensure residents feel supported, we provide 24/7 customer service, allowing them to speak with a real person at any time about their account, questions, or concerns. This level of accessibility fosters trust and helps us address issues before they escalate into missed payments or disputes.

How This Benefits You:

- Reduced Risk of Disputes: Proactive communication minimizes tenant misunderstandings and potential conflicts.

- Improved Retention Rates: When residents feel heard and supported, they are more likely to renew their leases.

- Operational Efficiency: Resolving issues quickly reduces administrative burdens and keeps operations running smoothly.

2. Flexible Payment Terms

Our Flex Pay program allows tenants to align their rent payments with their income schedules—whether weekly, bi-weekly, or monthly. This flexibility has been transformative for our residents and our portfolio: currently, one-third of our tenants participate in Flex Pay, resulting in a significant reduction in evictions and improved cash flow predictability.

How This Benefits You:

- Lower Eviction Costs: Fewer evictions mean reduced legal fees, repair expenses, and unit downtime (saving an average of $3,500 per eviction).

- Stable Occupancy Rates: Flex Pay helps tenants stay in their homes during financial challenges, reducing turnover and vacancy rates.

- Consistent Cash Flow: Flexible payment schedules ensure more timely rent collection, even during economic uncertainty.

3. Positive Credit Building

Through our initiative to report on-time rent payments to credit bureaus, we empower tenants to improve their credit scores. This program has already delivered significant results: last year alone, 35 residents became “credit visible” for the first time, with average credit score increases of 25–44 points. Many residents have transitioned from subprime to prime credit status as a result.

How This Benefits You:

- Increased Tenant Loyalty: Residents who see tangible financial benefits from renting with us are more likely to renew their leases.

- Stronger Communities: Financially stable tenants contribute to a healthier rental community with fewer delinquencies.

- Enhanced Reputation: Offering programs that improve residents’ financial well-being positions us as a landlord of choice in competitive markets.

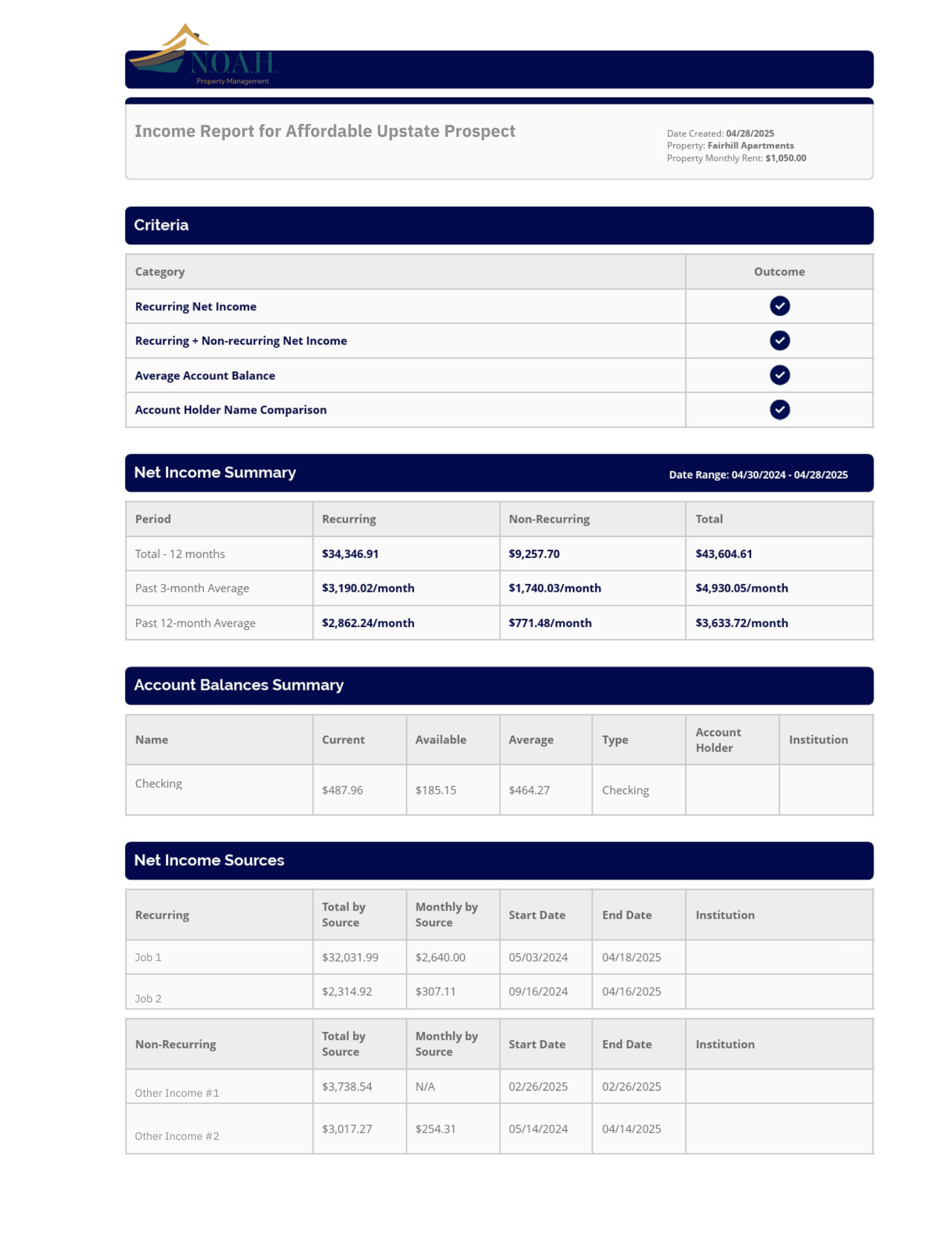

4. Advanced Tenant Screening Practices

To ensure we attract financially stable tenants while minimizing turnover risks, we’ve adopted Payscore, an automated income verification tool that uses bank-verified data rather than outdated or fraudulent documentation like pay stubs. Payscore allows us to assess applicants’ financial capacity in real-time with unparalleled accuracy.

How This Benefits You:

- Reduced Rental Fraud Risks: Payscore’s 100% bank-verified data ensures we only approve qualified applicants.

- Faster Leasing Decisions: Automated verification speeds up the approval process, reducing vacancy periods.

- Higher Quality Tenants: With improved screening accuracy, we maintain a portfolio of financially reliable residents.

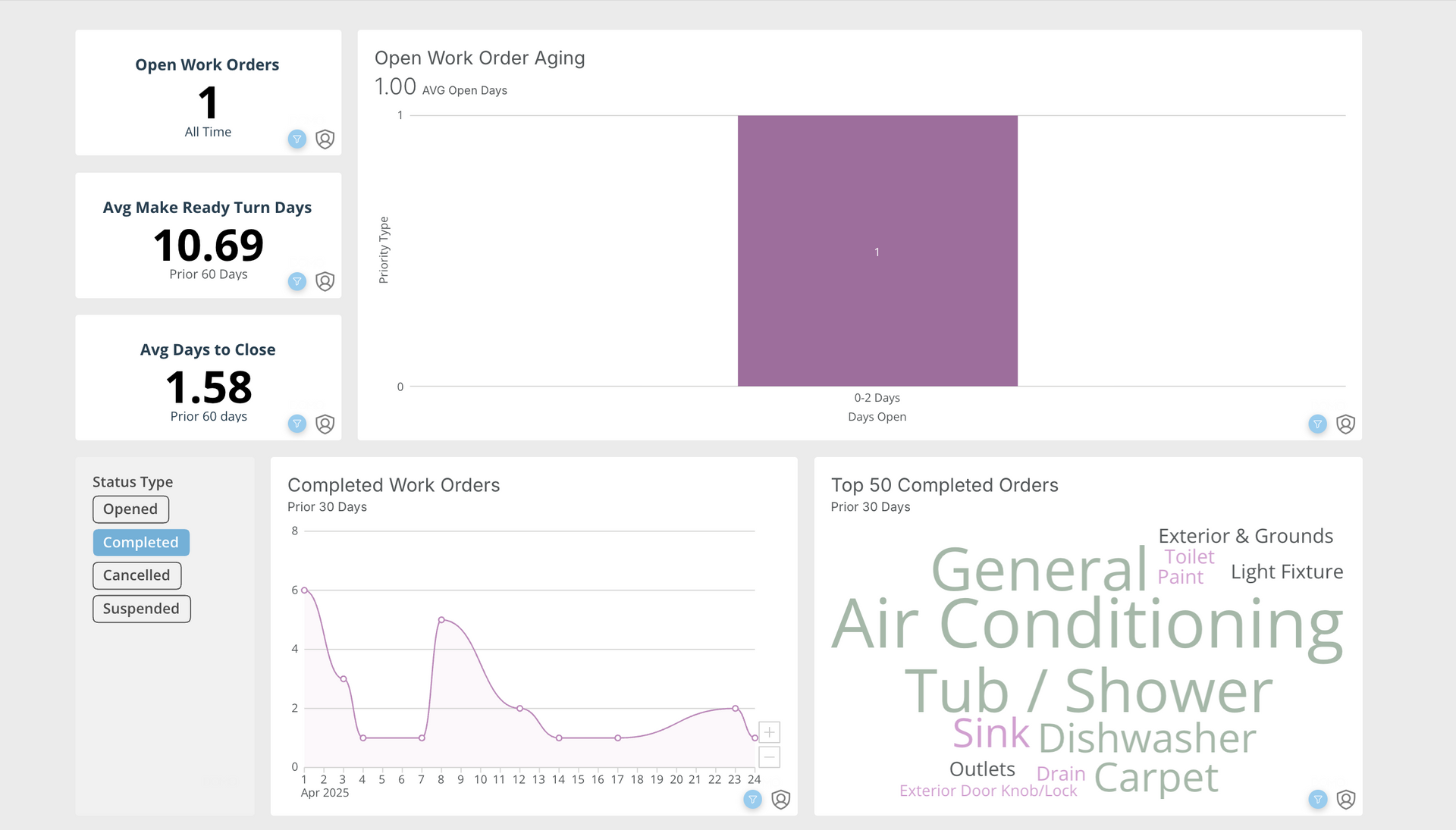

5. Prioritizing Retention Through Efficient Property Maintenance

We know that timely maintenance is critical for tenant satisfaction and retention. Across our portfolio, our average work order completion rate stands at an impressive 93%, reflecting our commitment to prompt service. Additionally, we’ve partnered with the nonprofit organization SAHA to deploy case managers onsite who provide personalized support for residents facing unique challenges—connecting them to resources like food programs or rent assistance.

How This Benefits You:

- Lower Turnover Costs: Satisfied tenants are more likely to renew leases, reducing costly vacancies and turnover expenses.

- Stronger Tenant Relationships: Personalized support from SAHA case managers fosters goodwill and community stability.

- Preserved Property Value: Prompt maintenance ensures properties remain in excellent condition, protecting your investment over the long term.

Navigating Challenges with Confidence

While stagflation presents undeniable challenges, it also offers opportunities for innovation in property management. By combining open communication, flexible payment options, tenant credit building, advanced screening tools like Payscore, and efficient maintenance practices with nonprofit partnerships like SAHA, we are not only mitigating risks but also positioning ourselves as leaders in this space.

These initiatives directly benefit you by reducing operational costs, improving tenant retention rates, ensuring consistent cash flow, and safeguarding the long-term value of your investments.

Thank you for your continued trust in us as we navigate these uncertain times together. If you have any questions about these strategies or would like more details on how they’re impacting your investments, please don’t hesitate to

reach out.