BLOG

Affordable upstate

How Corporate Earnings and Inflation Impact Real Estate Investing

If you follow financial media, you have probably noticed a lot of debate lately about whether the inflation the country has experienced the past year is transitory (as the Fed and bond market predict) or here to stay (as commodity markets are signaling).

It’s obvious that increasing costs will affect investment performance, but how? What types of investments outperform or underperform during inflationary or deflationary times?

In the 1990s Ray Dalio and his hedge fund, Bridgewater (now the largest hedge fund in the world), set out to answer those questions:

“I knew which shifts in the economic environment caused asset classes to move

around, and I knew that those relationships had remained essentially the same for hundreds of years. There were only two big forces to worry about: growth and inflation” -Ray Dalio

Dalio demonstrated that historically different asset classes outperform or underperform depending on if corporate earnings and inflation are growing or falling. If one can forecast those two factors, an investor can confidently invest in assets that have historically appreciated while those conditions existed.

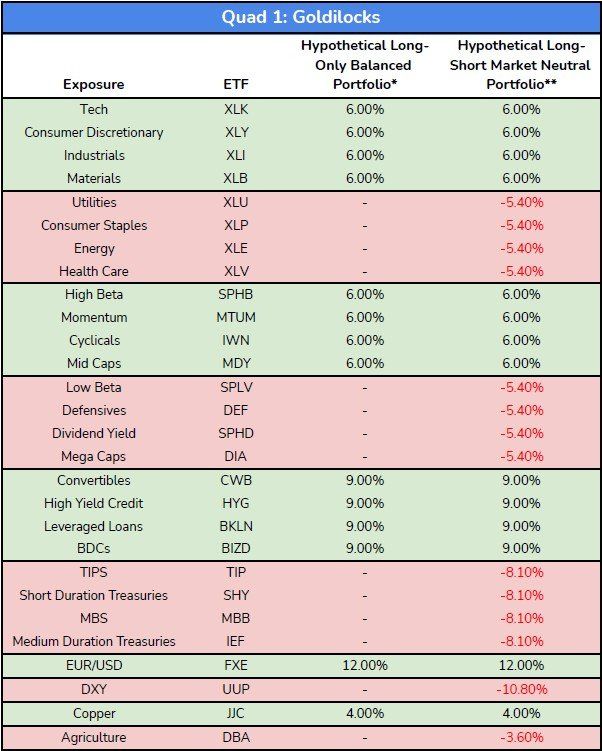

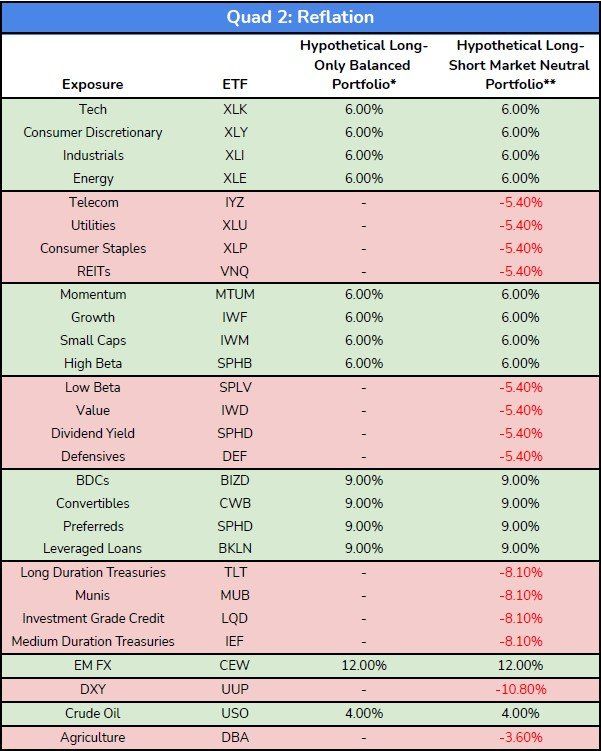

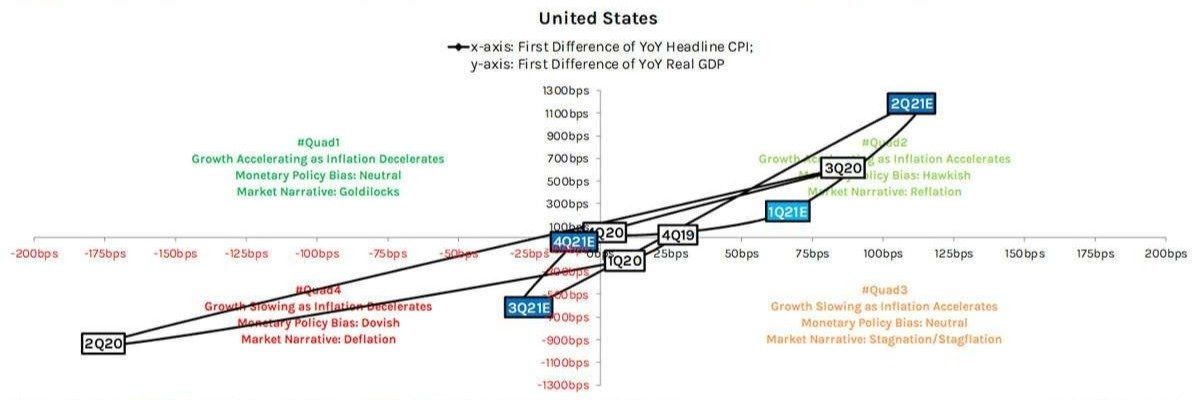

Hedgeye, an investment subscription service, publishes daily long and short investment calls using Dalio’s framework. Using basic calculus to divide investment strategies into four quadrants, their suggested asset allocations depend on whether corporate earnings growth and inflation are increasing or decreasing on a rate-of-change basis.

While they do excellent tracking of past performance, investors should trust their forecasts of the future just as much as they trust any other financial prognosticator. Personally, we incorporate their thinking into our investment strategy but assign only partial probability to their forecasts.

We recognize there is a decent probability they’ll be wrong, so we maintain hedges via alternative investments and options/futures contracts.

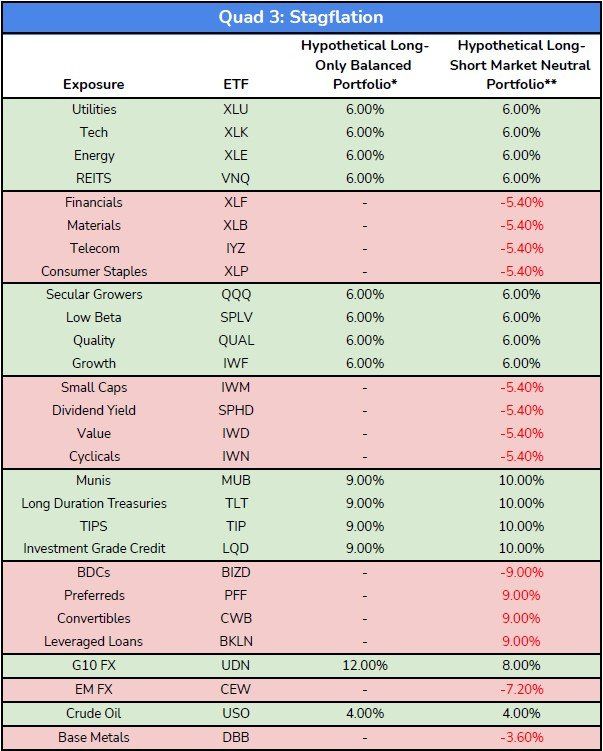

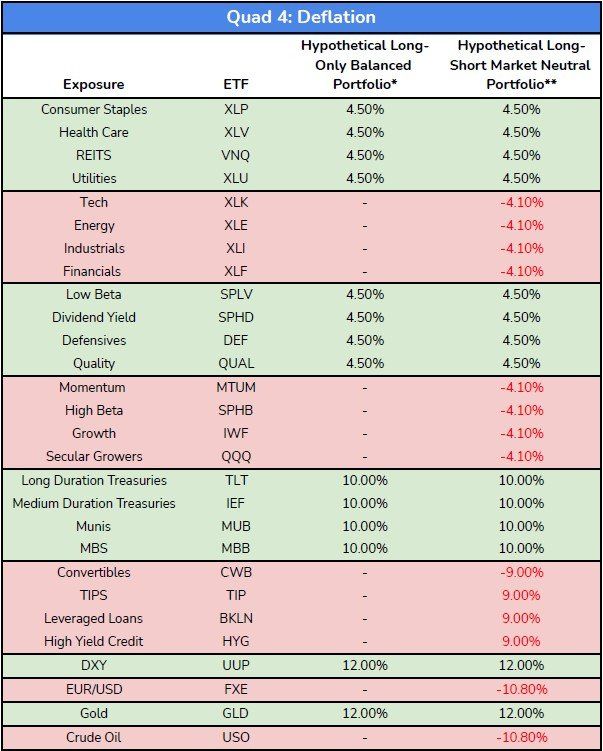

Below is how Hedgeye suggests allocating your assets through all earnings and inflation scenarios. Sectors in green denote suggested long exposures while sectors in red denote short exposures.

Increasing Earnings and Decreasing Inflation

Increasing Earnings and Increasing

Decreasing Earnings and Increasing Inflation

Decreasing Earnings and Decreasing Inflation

The chart below shows which quads the US economy has been in since late 2019 and which ones Hedgeye predicts we’ll be in for the rest of 2021.

As long-term real estate investors, we find following this investing framework useful in several ways:

Diversifying Investments Outside of Real Estate

It’s important to have exposure to investments outside of real estate. Values won’t go up forever and other sectors could provide upside if real estate experiences a downturn.

According to Dalio, “I saw that with fifteen to twenty good, uncorrelated return streams, I could dramatically reduce my risks without reducing my expected returns.”

The quad framework helps guide asset allocation decisions.

Hedging Risks

Some investors have high exposure to a particular investment sector due to their careers. Many high-level employees accumulate stock in their companies as a major part of their compensation and they’re often. Often they are not allowed to sell those positions for years. The same is true for business owners.

In many cases, it makes sense for those employees to own put options on those concentrated holdings. Options need to be managed as they expire and using the quad framework can help investors make option buy/sell timing decisions.

Timing Debt Refinances

Commercial real estate investors typically have debt that balloons within 5-10 years, requiring it to be continually refinanced. If refinances can be timed when interest rates are low, it can result in higher cash flow and more cash-out proceeds.

Investors can use the quads to time refinances during deflationary periods when interest rates are falling.

Managing Construction Costs

Construction costs increase during inflationary times, limiting investment returns on ground-up development and value-add real estate investing. Timing supply purchases during deflationary periods can greatly increase returns on heavy construction projects.

No one financial prognosticator can definitively forecast how the market will perform. They can, however, provide valuable insight on how certain economic conditions directly impact asset classes, rooted in historical data. Sophisticated investors use this insight as a discretionary tool to make critical investment decisions based on current and future corporate earnings and inflation projections.

The information contained in this post is provided to you solely for informational purposes only, and is not to be shared, distributed, or otherwise used for any other purpose without direct reference to Affordable Upstate or link back to this post. This post is provided for education and discussion purposes only and does not constitute an offering. Opinions and projections included in this post are provided as of the date of publication, may prove to be inaccurate, and are subject to change without notice. Prospective investors should not treat these materials as advice regarding legal, tax, or investment matters. No recommendations are made to invest in Affordable Upstate nor any other investment. An offering may be made only by delivery of a confidential offering memorandum to appropriate investors. Past performance is no guarantee of future results. Additional information about Affordable Upstate and its performance is available upon request.